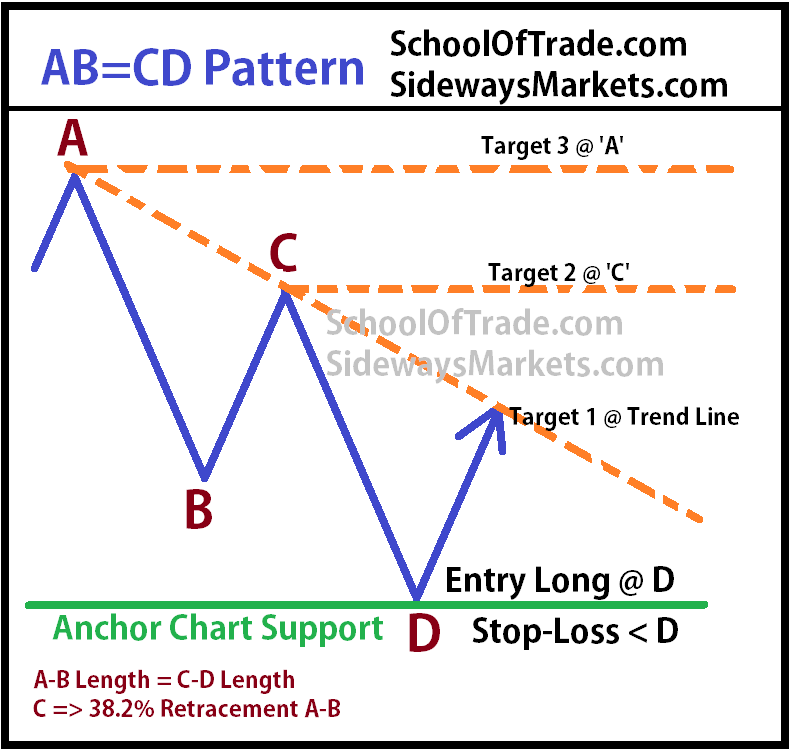

This creates a more symmetrical abcd pattern.Ĭlassical harmonic pattern theory suggests that you measure the distance between the AB and BC move as well as the BC and CD moves. You can see in this next image that we have connected the middle of the B to C pullback instead of the high and low. Lastly, you'll start your third and final trendline from the high of C to the low of D.Īnother school of thought connects the middle of the trend.

To draw it correctly, wait for the top or bottom to form on the B to C pullback, then you can attach this line to the first line you draw from the high of A to the low of B.

Once you identify this first leg, you can then anticipate the B to C pullback. This needs to be a strong move up or down. In order to draw the ABCD pattern for day trading, you will need to identify the first leg from A to B. Thus, the classical example of an abcd pattern predicts that in a downtrend "D" is an area to go long. However, like the long example, the idea is that once sellers have a "three-wave" move down, it will likely result in a near-term reversal pattern at D. It is also why the consolidation in C produces a higher low.Ĭonversely, in a downtrend, sellers are in control the entire way from A to D. From A-B and C-D bulls are pushing the stock higher and higher with aggressive demand. Then, once the C to D portion of the move is complete, it often signals a bearish reversal. The initial intrada swing from A to B consolidates briefly in B to C. Typically, an abcd pattern in trading that is pointing upward is an indication of a bearish reversal. This also depends a lot upon where the "D" area of the pattern coincides with support or resistance. The pattern is often used to predict a trend continuation or a trend reversal depending on where your entry is taken.

0 kommentar(er)

0 kommentar(er)